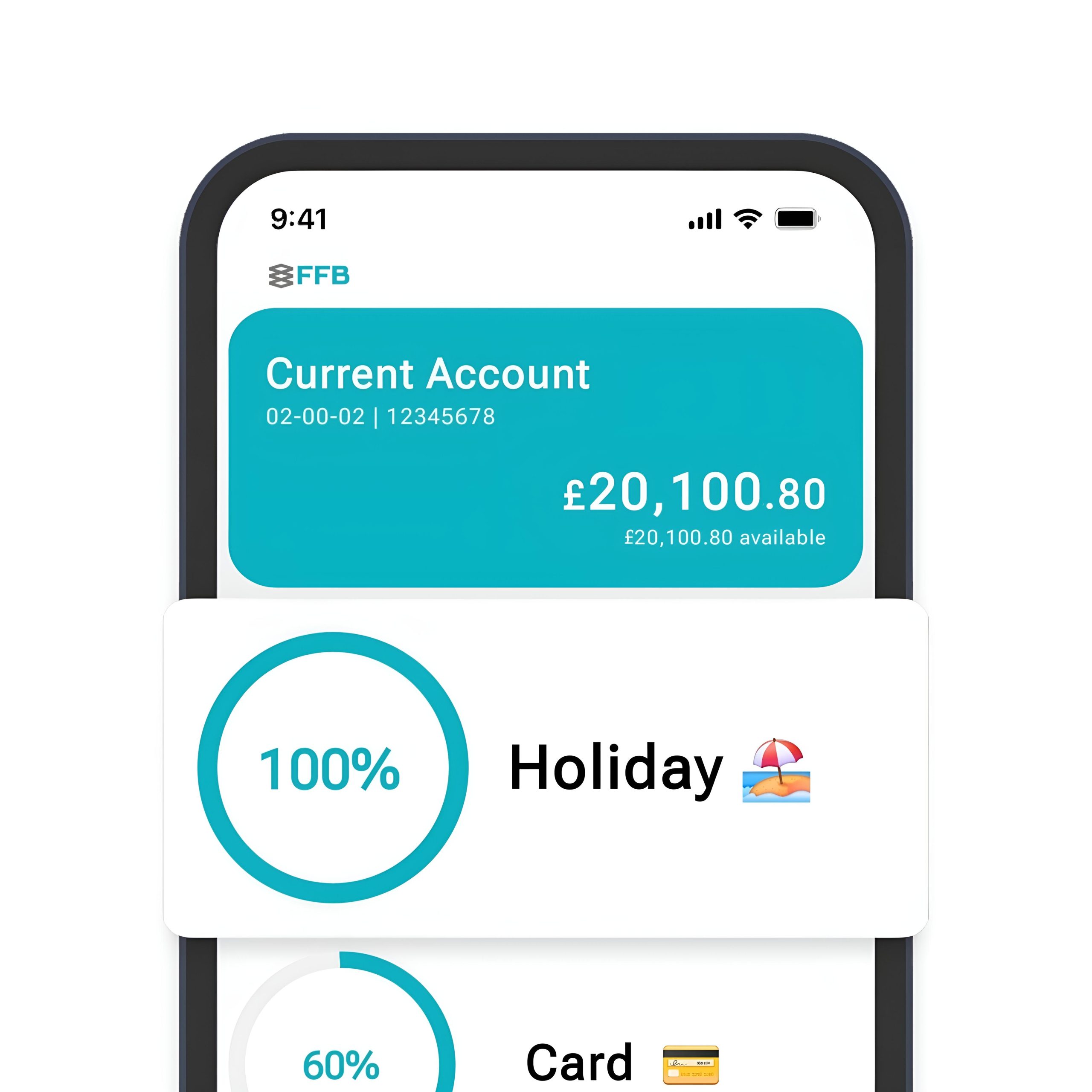

Whether you’re getting paid, shopping, saving, or spending—your Finny Finance current account is ready to support your everyday journey.

Enjoy 24/7 access that makes banking simple and efficient.

Manage your money easily, make instant payments, and stay in full control anytime, anywhere with zero monthly fees.

Whether you’re getting paid, shopping, saving, or spending—your Finny Finance current account is ready to support your everyday journey.

Enjoy 24/7 access that makes banking simple and efficient.

Power your daily transactions with secure, flexible, and smart banking.

Open your account quickly with 100% digital verification.

Stay updated with real time notifications on every account activity.

Download monthly statements with a click, anytime, anywhere.

Shop, withdraw, and manage finances with an easy-to-use debit card.

Trusted protection for your money and personal data.

Complete your banking tasks without any paperwork, from anywhere.

Discover the interest rates and fees that apply to your current account.

We believe banking should work around your schedule, not the other way around. That’s why our current account is fully online and always open.

Key requirements to qualify for a current account.

Full name, date of birth, nationality, and contact details (phone number and email)

Must be at least 18 years old

Valid government-issued ID

Recent utility bill or government correspondence showing current address

Find clear answers to the most common questions about

our services accounts, and support.

Yes, you can apply for personal, auto, or business loans through our website. Our team will review your application and get in touch with you promptly.

You can activate your card through your online banking account, by contacting our customer support. Instructions are also provided with the card.

Report suspicious activity immediately by contacting our fraud team. We will investigate the issue and guide you through the dispute process.

Immediately contact our support or block the card via online banking. A replacement card can be issued and mailed.

The standard ATM withdrawal limit is [$500 or equivalent local currency] per day. You can request a temporary increase by contacting our support team.

If you didn’t find what you’re looking for contact us.